|

|

| January 31, 2008 |

|

|

FusionIQ Commodity Group Still Showing Strength |

|

|

|

As seen in the chart

below the FusionIQ subgroup, Commodities, which includes a variety of ETF's,

such as the GLD (streetTRACKS Gold Trust), the

DBA (The Powershares Agricultural Tracking Stock) and the

SLV (the iShares Silver Trust) to name a few has moved

to new highs. There are very few leadership groups in this tape and strength

given the recent across the board carnage strong groups have to be recognized,

particularly when there is good representation within the groups a/d line as it

pushes to new highs. Additionally with the backdrop of aggressive fed easing

commodities should do well in a re-inflation scenario.

|

|

|

|

| January 30, 2008 |

|

|

Trizetto Group (TZIX) - New FusionIQ Short Squeeze |

|

|

|

The TriZetto Group

(TZIX), which delivers third party packaged and proprietary software

applications, Internet infrastructure, and front-end portal access broke out

yesterday clearing resistance on 3.17 times its 21 day average volume. The stock

also scored a new FusionIQ timing BUY signal and has 15.18 % of its float short.

After a surge like yesterdays we would suggest buying on a minor pullback. The

point and figure target for the double top breakout is $ 28.50. A stop could be

set along with your own risk tolerance or below yesterdays low.

|

|

|

|

| January 29, 2008 |

|

|

SYBASE (SY) New Buy FusionIQ Technical Rating of 98 |

|

|

|

Sybase Inc. (SY) just reported a very strong quarter with gross margin improvements, across the board strength and a solid outlook.

From a catalyst perspective, activist shareholder Sandell Asset Management (A firm headed by an ex Carl Icahn fund employee) recently upped their stake in Sybase by 1.18 million shares raising their total holdings to 5.4 million shares or roughly 6.03 % of the shares outstanding. One of their first orders of business is to propose their own slate of candidates to be nominated to the board of directors. This supports a view that Sybase is clearly a prime candidate for continued additional activist involvement or an outright takeout.

With JAVA buying MYSQL (Lnux DBSE vendor) last week, it would not be surprising to see another hardware vendor scoop up Sybase. Expectations are still relatively low with only 3 buys 4 holds and 1 sell. Trading at an EV/Rev's of approximately 2.10 and 14 x consensus 08 EPS, Sybase is not expensive. In a consolidating sector with technology that's relevant, we would recommend a long position in SY with near term catalysts of additional activist news flow.

Technically this has been one of the strongest tech stocks in a weak tape. Stocks that act strong in a bad environment always stand out as it shows conviction on the part of buyers. With good base support and a strong uptrend from the 2003 lows still intact, SY shares can be accumulated on an average cost basis here and on pullbacks. Only a violation below $ 22.50 would turn the story outright bearish – a tighter stop could be placed under the recent weekly reversal low near $ 24.00 for those who want to tighten up the risk. Our point and figure derived projected upside target is $ 34.50.

|

|

|

|

| January 28, 2008 |

|

|

Latest Buy & Sell Signals |

|

|

|

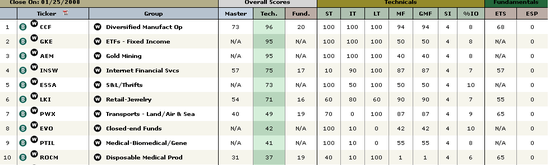

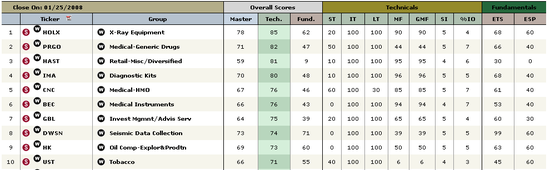

These are the most recent Buy & Sell signals the system has generated.

Top 10 Buy Signals

Top 10 Sell Signals

Note: Stocks ranked highest in this univese tend to outperform stocks rank lowest.

|

|

|

|

| January 25, 2008 |

|

|

PRXL 99 Rating Beats Earnings EST in Q2 |

|

|

|

PAREXEL International Corporation (PRXL) is a contract research and product launch organization. The Company provides outsourcing services to the worldwide pharmaceutical, biotechnology and medical device industries. PAREXEL has operations in various countries around the world.

PRXL shares broke out yesterday after trading five times its normal volume after 2nd quarter profits rose 26%. This is the 7th time in the last 8 quarters that PRXL has beating analyst estimates. The company also projected higher 3rd quarter growth based on higher service revenue and a large backlog.

The point and figure projected target on the breakout is $ 65.00 – Buying on pullbacks is suggested after yesterday’s large price spike.

|

|

|

|

| January 23, 2008 |

|

|

Timely Sell Signal - Goggle Inc. (GOOG) |

|

|

|

Trading GOOG with its volatile swings can be trying and at sometimes a dart throw. However by using our unbiased timing algorithms FusionIQ gives its users and un-emotional way to make more educated decisions as to when to trade. As seen below the FusionIQ sell signal on GOOG based on its 1/16/08 closing price was very timely with the stock dropping over $ 100 pts (based on today’s intraday low) in the 5 days since the signal triggered.

|

|

|

|

| January 23, 2008 |

|

|

More Sentiment Data |

|

|

|

CBOE Volatility Index (VIX) – As seen in the chart below the CBOE Volatility Index (VIX), which indirectly looks at fear in the options market by examining the premiums investors pay for puts of varying strikes, has broken out to new highs. This coupled with other sentiment indicators suggests a near term low is close at hand.

|

|

|

|

| January 23, 2008 |

|

|

More Sentiment Data |

|

|

|

CBOE Equity and Index Put/Call Ratio – As seen in the chart below the CBOE Equity/Index Put/Call Ratio hit levels yesterday associated with previous market lows. While not infallible it is one more indicator that suggest we are closing in on a possible low.

|

|

|

|

| January 22, 2008 |

|

|

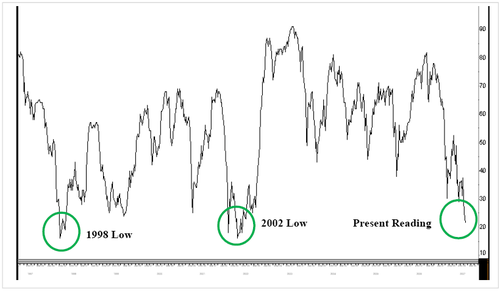

Sentiment The Same as 1998 and 2002 Lows |

|

|

|

As seen in the attached chart the American Association of Individual Investors (AAII) Sentiment a gauge of individual investor sentiment, small investors are extremely nervous. Typically readings this low suggest many investors have already sold out of the market and are on the sideline. This removal of massive selling pressure is symptomatic of bottom formations. As seen the current readings are at similar levels as the 1998 and 2002 lows. This suggest to us that in the near term a reprieve rally may take place and provide a short-term opportunity to make trade able long gains.

|

|

|

|

| January 22, 2008 |

|

|

Dow Bouncing Off Support |

|

|

|

As seen in the attached image the DOW JONES INDUSTRIAL AVERAGE has at least for the moment attempted to stabilize at a prior support level near 11,650 (red line). This along with the fed’s cut of 75 bps may for the moment provide a short-term low for the markets. However given the overall damage of late in the market ultimately these levels are likely to be violated. We would use any strength to identify candidates to either add or remove from your portfolio on any bounces.

|

|

|

|

| January 17, 2008 |

|

|

NYSE % of stocks > than 200 Day Moving Average |

|

|

|

NYSE % of stocks > than 200 Day Moving Average

As seen on the chart above the percentage of NYSE stocks > than their 200 day moving average has

slipped (not incl. today) to almost 20%. This reading is similar to readings at other past significant lows such as the 1998 low and the 2002 low.

That said we don’t think we have seen the absolute low in the markets yet given the recent trend line break in the S&P 500. However, given these indicator readings we are starting to see the signs of a capitulation building one more shot down may be necessary to set a better, more solid low.

|

|

|

|

| January 16, 2008 |

|

|

SHOO(s) Not In Style Anymore |

|

|

|

Two strong Sell signals on SHOO in the last 6 months, including a recent Sell in late December

The stock has since dropped over 25%:

click for larger chart

&

|

|

|

|

| January 15, 2008 |

|

|

Acorda Therapeutics |

|

|

|

Acorda Therapeutics (ACOR) a biotechnology company that is developing therapies for spinal cord injury and related neurological conditions broke out in Fridays weak tape on 2.31 times its 21 day average volume. Beyond the breakout, the stock has 13.21 % of its float short, so a short squeeze could bring about a positive liquidity catalyst as well. The recent breakout completed a large base and implies higher prices.

On pullbacks towards $ 23.25 to $ 23.00 shares may offer an attractive entry point. A tight stop could be set under $ 22.00 to limit downside risk and prevent damage in case this turns out to be a false breakout.

|

|

|

|

| January 14, 2008 |

|

|

Sears (SHLD) |

|

|

|

Sears stock is off 6.3% today, on disappointing earnings news.

You didn't have to wait for earnings, however -- the stock has been on a Fusion IQ Sell Signal since July 2007, with several reiterations since:

|

|

|

|

| January 14, 2008 |

|

|

Barron's Quant Rankings |

|

|

|

These are the stocks in Barron's this weekend, and their master quant rankings in our system . . .

Note that many of these are on a Short-Term Sell Signals, and none have a score greater than 70. Given the macro tendencies of the Barron's Roundtable, they may be early in the calls.

Hence, these are worth watching over the next quarter for buying -- but none are really actionable immediately.

|

|

|

|

| January 11, 2008 |

|

|

Squawk Video |

|

|

|

Here's the video from CNBC.com:

click for video

Predictions on

Target: Calls for

2008, with Barry Ritholtz, Fusion IQ CEO/director of equity research, and CNBC's

Erin Burnett

|

|

|

« December 2007 |

Main Index |

Archives

| February 2008 »

|

|

|

|

|

|