Retail Sales for October in line ...

After two stronger than expected retail sales reports, the October data were in line with expectations for modest growth outside the very volatile auto segment. Autos remain the main story driving the large top-line increase. They recovered smartly following the post-clunker retreat in September. Sales are currently above their year-ago level, despite the possibility of some sales loss from clunker sales in August.

Fundamentally, the backdrop for consumers remain poor as wage income is more than 5% below its year-ago level and is not growing appreciably, although the declines have ended. Additionally household wealth is substantially below its prior levels, although some of the pressure may have been removed by the recent increase in equity and home prices.

Add this altogether and factor in no further tax cuts or increases in government payments and consumers will likely remain financially constrained for some time.

Retail Sales for October in line ...

After two stronger than expected retail sales reports, the October data were in line with expectations for modest growth outside the very volatile auto segment. Autos remain the main story driving the large top-line increase. They recovered smartly following the post-clunker retreat in September. Sales are currently above their year-ago level, despite the possibility of some sales loss from clunker sales in August.

Fundamentally, the backdrop for consumers remain poor as wage income is more than 5% below its year-ago level and is not growing appreciably, although the declines have ended. Additionally household wealth is substantially below its prior levels, although some of the pressure may have been removed by the recent increase in equity and home prices.

Add this altogether and factor in no further tax cuts or increases in government payments and consumers will likely remain financially constrained for some time.

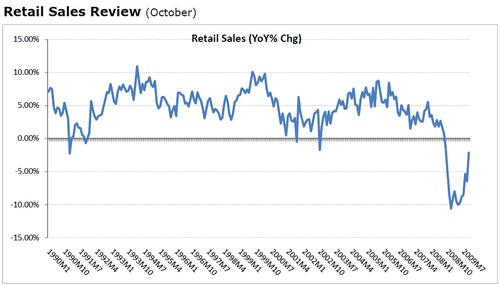

Retail Sales Review 11/16/09

Retail Sales Stronger - Auto's Rise

After two stronger than expected retail sales reports, the October data were in line with expectations for modest growth outside the very volatile auto segment. Housing related segments posted large declines, as did sporting goods and hobby stores. The latter has been a strong performer in recent months, so the decline should not be taken seriously. Encouragingly, restaurant sales outperformed grocery stores. If sustained, this would suggest less consumer retrenchment.

Autos were the main story driving the large top-line increase. They recovered smartly following the post-clunker retreat in September. Sales are currently above their year-ago level, despite the possibility of some sales loss from clunker sales in August. This is a positive sign, as consumers are unlikely to make major purchases in times of major financial problems. Unfortunately, this positive sign is offset by the continued weakness in sales at housing related retailers. One reason could be the recent firming of home sales has not had time to boost retailer sales. Another is that consumers stretched so much to take advantage of the government incentive to purchase the home, they had nothing left for furniture or improvement.

Fundamentally, conditions remain poor for consumers, and spending will be limited. Wage income is more than 5% below its year-ago level and is not growing appreciably, although declines have ended. Wealth is substantially below its prior levels, although some of the pressure may have been removed by recent increases in equity and house prices. No further tax cuts or increases in government payments are legislated, although past actions continue to support disposable income. Asset income is still falling, although with the recession over, there are reasons to believe declines may be nearing an end.

Consumers remain financially constrained; they lack the cash to spend aggressively. However, there is also less reason for them to cut spending aggressively than there was six months ago. In this environment, spending will take a firmer tone than late last year or early this year, although consumers will not lead the recovery. Further, easing comparisons ensure improved year-ago results, with reports of growth likely to become more common.

China: Low US interest rates threaten recovery

China's banking regulator says low US interest rates are risk to global economic recovery Bottom of Form

BEIJING (AP) -- China's top bank regulator said Sunday the weakening U.S. dollar and low interest rates are spurring speculation in stocks and property, distorting global asset prices and threatening the global economic recovery.

The situation poses an "insurmountable risk to the recovery of the world economy," Liu Mingkang, chairman of the China Banking Regulatory Commission, warned just hours before President Barack Obama was due to arrive in China.

Speaking at a conference in Beijing, Liu said the declining U.S. dollar and reassurances by officials that interest rates will remain low were encouraging a "massive" U.S. dollar carry trade -- the practice of borrowing money at low rates in one currency to invest in assets in another currency that offer a higher return.

The carry trade is "dealing a serious blow to global asset prices and fueling speculation in the stock and real estate markets," he said, according to a transcript of a speech he made at a financial forum in Beijing, posted on the Web site of Hong Kong's pro-Beijing Phoenix TV.

The U.S. dollar has declined steadily since spring despite statements of support from American officials. China is the largest foreign holder of U.S. debt, mostly in the form of Treasury securities, which have declined in value as a result of the dollar's weakness.

At the same time, record-low U.S. interest rates, intended to encourage lending to businesses struggling to recover from the recession, are spurring investors to transfer funds out of the safety of low-yield dollar-denominated investments such as Treasury securities and into higher-yielding assets like stocks, commodities and emerging-market currencies.

Strong flows of such funds into China's markets, where share prices have surged by more than 70 percent this year, and property have raised worries over a possible bubble in asset prices that might later implode, causing financial problems.

Source: AP

November 14th 2009

China: Low US interest rates threaten recovery

China: Low US interest rates threaten recovery

China's banking regulator says low US interest rates are risk to global economic recovery

- On 7:07 am EST, Sunday November 15, 2009

BEIJING (AP) -- China's top bank regulator said Sunday the weakening U.S. dollar and low interest rates are spurring speculation in stocks and property, distorting global asset prices and threatening the global economic recovery.

The situation poses an "insurmountable risk to the recovery of the world economy," Liu Mingkang, chairman of the China Banking Regulatory Commission, warned just hours before President Barack Obama was due to arrive in China.

Speaking at a conference in Beijing, Liu said the declining U.S. dollar and reassurances by officials that interest rates will remain low were encouraging a "massive" U.S. dollar carry trade -- the practice of borrowing money at low rates in one currency to invest in assets in another currency that offer a higher return.

The carry trade is "dealing a serious blow to global asset prices and fueling speculation in the stock and real estate markets," he said, according to a transcript of a speech he made at a financial forum in Beijing, posted on the Web site of Hong Kong's pro-Beijing Phoenix TV.

The U.S. dollar has declined steadily since spring despite statements of support from American officials. China is the largest foreign holder of U.S. debt, mostly in the form of Treasury securities, which have declined in value as a result of the dollar's weakness.

At the same time, record-low U.S. interest rates, intended to encourage lending to businesses struggling to recover from the recession, are spurring investors to transfer funds out of the safety of low-yield dollar-denominated investments such as Treasury securities and into higher-yielding assets like stocks, commodities and emerging-market currencies.

Strong flows of such funds into China's markets, where share prices have surged by more than 70 percent this year, and property have raised worries over a possible bubble in asset prices that might later implode, causing financial problems.

Source: AP November 14, 2009

http://finance.yahoo.com/news/China-Low-US-interest-rates-apf-4089984647.html/print?x=0

10 years and the market still at 10,000 !!!!

Interesting New York Times article about the market valuation:

“Market valuations are another consideration. By almost every measure, stocks are far cheaper at Dow 10,000 today than at Dow 10,000 in March 1999.

Back then, the price-to-earnings ratio for domestic stocks stood at a very high 41.4. That’s based on 10-year average earnings, a conservative measure that smoothes out short-term swings in corporate profits. Since then, using the same measure, the market’s P/E has fallen to 18.9. While that’s not necessarily a screaming bargain — the market’s long-term average is closer to 16 — stocks are trading at a discount of more than 50 percent to their 1999 prices.”

That would seem to argue for the value player’s approach to investing. And over long periods of time (decades), the value approach is indeed valid.

However, academic studies have shown conclusively that it is your asset allocation strategy that is the greatest determiner of your returns. The best stockpickers out there got crushed if they were 100% long US equities in 2008; The worst bond mangers still did well relatively.

Consider:

“The return to 10,000 also serves as a bitter reminder that stocks have gone virtually nowhere, on balance, for more than a decade. It was in March 1999 that the Dow first climbed above 10,000, before soaring as high as 14,164 two years ago and plummeting as low as 6,547 this past March . . .

Look a bit deeper, though, and you’ll find that there have been some changes in the domestic market, too, in the last 10 years — and largely for the better. Some of them, however, are hard to see at first glance.

For example, a majority of sectors have actually posted positive returns since the end of 1999 — in some cases sizable gains. On average, including dividends, energy stocks have returned nearly 150 percent, shares of consumer staples companies (like Procter & Gamble and others that sell necessities) have gained nearly 65 percent and utility stocks have risen nearly 50 percent . . .” (emphasis added).”

What is also be worth looking at are other investable asset classes beyond US equities: How did emerging markets do? Convertible Bond Arbitrage? Private Equity? Real Estate? Commodities? Munis? Gold?

Even within the equity slug of your allocation, there are small cap value, big cap tech, alt.energy, etc. that may have outperformed the overall market over the same time period.

And when all of the above asset classes become correlated and start to head down, as they did last October, that is your signal to move aggressively to cash.

The overall conclusion of this article, which the Times did not explicitly state, is that most investors would be better off with an asset allocation strategy rather than sticking to the traditional stock picking or even index approaches so common amongst mom and pop . . .

Source:

10 Years Later, a Much Less Expensive Dow 10,000

PAUL J. LIM

NYT, November 14, 2009

http://www.nytimes.com/2009/11/15/business/economy/15fund.html

Inside Trading Becomes 'Systemic' at Hedge Funds, Khuzami Says

Interesting article from Bloomberg.com. It shows that maybe these hedge fund stars have had stellar returns because they cheat a bit !!

Insider-trading cases among hedge funds including Galleon Group LLC may reflect a “systemic” behavior that has spread within the industry, Securities and Exchange Commission Enforcement Director Robert Khuzami said.

“You have funds whose business model consisted of vigorous attempts to collect information from corporate insiders and to utilize that information to trade,” Khuzami said yesterday at the Bloomberg Washington Summit. Such an approach is “potentially more dangerous” than previous insider-trading cases that reflected “opportunistic” behavior, he said.

The SEC has sued more than 20 people and firms in the past month, including billionaire Raj Rajaratnam and his New York- based hedge fund Galleon Group, in a broader crackdown on insider trading. The lawsuits, based in part on wiretaps and years of data-mining, allege that hedge-fund managers and traders obtained tips, at times in exchange for payment, on corporate deals and earnings that generated as much as $53 million in illegal profits.

“I’m sure that the vast majority of hedge funds and others operate in a lawful manner,” Khuzami said. “However there are some aspects to hedge-fund operations that do give enforcement types like myself concern,” he said, citing algorithmic trading, dark pools and the lack of a corporate culture of compliance among the issues. In a dark pool, trades are matched without posting quotes on public exchanges.

Laws forcing hedge funds to register with the SEC will increase transparency and improve compliance, he said.

Tips ‘Uptick’

Rajaratnam and his accomplices were part of a network that shared confidential tips on at least 10 companies, including Google Inc., Hilton Hotels Corp. and Intel Corp., investigators said Oct. 16. The lawsuits name witnesses who cooperated with authorities. Rajaratnam and the others have denied wrongdoing.

Since the arrests were announced, the SEC has seen an “uptick” in individuals coming forward with information on misconduct, Khuzami said, adding that people trading on confidential information “should be worried.”

Khuzami, 53, said prosecutors will continue using undercover techniques including informants and front businesses to attract wrongdoing and wiretaps to “ferret out” misconduct. The SEC has endorsed legislation that would let the agency pay whistleblowers for information leading to a case.

Khuzami, a former federal prosecutor who joined the agency in March, is reorganizing the division to add front-line investigators, speed inquiries and create specialized units after the agency was faulted for missing Bernard L. Madoff’s Ponzi scheme. He’s also seeking to bolster his attorneys’ powers by gaining greater access to grand-jury evidence and expanding deal-making and cooperation with informants.

The SEC is also looking “closely” at laws in the 2002 Sarbanes-Oxley Act, which let the SEC punish executives for misconduct at firms even when they aren’t involved in the wrongdoing, he said last month. Sarbanes Oxley was enacted to combat corporate fraud after accounting scandals at Enron Corp. and WorldCom Inc. shook investor confidence.

Source:

Bloomberg.com November 13th 2009

http://www.bloomberg.com/apps/news?pid=20601087&sid=aZvZRD_LD7jg&pos=3

S&P 500 and Dollar Index still inversely correlated ...

As the attached chart shows the falling dollar continues to be a benefit to stocks and remains inversely correlated to equity prices. The short-term benefits of a weaker dollar are clear: Higher equity prices, exports and corporate profits in coming quarters that will support economic growth. Longer term the downside to a weaker dollar is the increased cost of financing the U.S. budget deficit and a reduction of consumers' purchasing power. The more immediate risk is that further downward pressure on the dollar will drive up oil prices to the point of constraining household spending.

Hedge Fund Manager Paulson loads up on Citigroup (C) and sells Goldman Sachs (GS)

80% of S&P 500 Companies Beat Expectations

Record Earnings Beat for S&P 500

According to Bloomberg: Eighty percent of S&P 500 companies that have released results exceeded the average analyst estimate for third-quarter earnings per share, marking the highest proportion for a full quarter in Bloomberg data going back to 1993, even as profits slumped for a record ninth straight quarter.