Badge Of Honor

Jim Cramer, financial troll, hates the Facebook IPO. Sounds You worried?

Badge Of Honor

Jim Cramer, financial troll, hates the Facebook IPO. Sounds like a raging buy signal.

Verizon (VZ) Shares continue to buck market weakness

VZ shares, with their defensive nature and 100% domestic revenue generation (ie. not dependent on Europe to make $ !) continue to buck market weakness and trade higher, after breaking out above resistance (red band) recently.

General Disclosure

This communication is for informational purposes only. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. All market prices, data and other information are not warranted as to completeness or accuracy and are subject to change without notice. Any comments or statements made herein do not necessarily reflect those of Fusion Holdings LLC, its subsidiaries and affiliates. This transmission may contain information that is privileged, confidential, legally privileged, and/or exempt from disclosure under applicable law. If you are not the intended recipient, you are hereby notified that any disclosure, copying, distribution, or use of the information contained herein (including any reliance thereon) is STRICTLY PROHIBITED. Although this transmission and any attachments are believed to be free of any virus or other defect that might affect any computer system into which it is received and opened, it is the responsibility of the recipient to ensure that it is virus free and no responsibility is accepted by Fusion Holdings LLC., its subsidiaries and affiliates, as applicable, for any loss or damage arising in any way from its use. If you received this transmission in error, please immediately contact the sender and destroy the material in its entirety, whether in electronic or hard copy format.

Research Disclosure

Fusion Analytics Software Development Partners, LLC (“FUSIONIQ”) is not registered as an investment adviser with the SEC or any state securities agency. Rather, FUSIONIQ relies upon the “publisher’s exclusion” from the definition of “investment adviser” as provided under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. The site content and services offered thereon are bona fide publications of general and regular circulation offering impersonalized investment-related information to users and/or prospective users (e.g., not tailored to the specific investment needs of current and/or prospective users). To the extent any of the content published as part of the site or services offered thereon may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person.

Wisdom Of Fools

Buy and hold strategies and 60/40 portfolio allocations not working anymore? You don’t say.

http://www.investmentnews.com/article/20120516/FREE/120519945

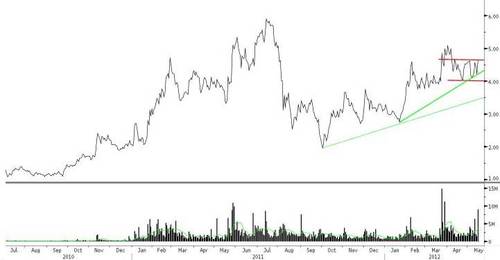

GLU Mobile (GLUU) - possible short squeeze

GLUU shares are consolidating nicely and yesterday they moved up on big volume. With almost 20.00 % of its float short and the company presenting at some brokerage conferences in the next few days shares may be ripe for a short squeeze. Minor resistance lies near $ 5.20, however nothing significant until the 2011 peak near $ 6.00.

Mystery Machine

You’re worth $4.84 a year to Facebook, in case you were wondering.

http://www.cnn.com/2012/05/16/tech/social-media/facebook-users-ads/index.html?hpt=hp_c1

FusionIQ Russell 2000 Outlook

The Russell 2000 has been capped by resistance since 2007 (red lines and arrows) near 850. So at this juncture in order to really embrace small cap, the market needs to show it can rip through this level, since so far it has failed to since 2007 ! The R2000 is now nearing a support zone (green lines) near 775 - 750. If that is violated the weakness continues. At this point you're in a range between support and resistance and it can go either way, thus it makes no sense to take a big swing either way.

It boils down to risk tolerance (do you buy here with tight stops and blow out on a breach of support ? or Do you wait and pay up on a confirmed break out above resistance to make sure a durable move is under way ? - for me I am vote for the latter.) Everyone is saying stimulus is good for equities and equity values should rise, yet they are struggling here. Most likely recent activity is correcting the excesses, and the usual summer weakness, however at this point it makes sense to observe, more than participate, until the odds line up better for a better pitch to swing at.Sangre de Toro

Here’s the problem, that $2B was real money, not synthetic.

Send In The Clowns

On the plus side, he’s old enough to remember Jimmy Carter.

A Dingo Ate My Trader

Henry Blodget sends Wall Street to the Principal’s office.